How to Innovate a Product? – Part 2

Table of contents

- 4.1 Communication Idea

- Communication Insight

- 4.2 Packaging / User Interface

- 4.3 Pricing

- 4.4 Amplification: Media and Partnerships

- 4.5 Distribution

- For DUREX Mutual Climax

This is Part 2 of a two-part series on launching innovations. You can view Part 1 on How to come up with an innovation here.

In this part, we cover aspects about how to bring your innovation to life, including how to

- Come up with an impactful communication idea,

- Design packaging that adds to the proposition

- Figure an appropriate price strategy,

- Create a high “RoI” media plan

- Build an effective distribution and Go-to-market plan

So let’s begin!

4.1 Communication Idea

Our next job is to bring our product/ service idea to life through impactful communication that inspires our consumers to act.

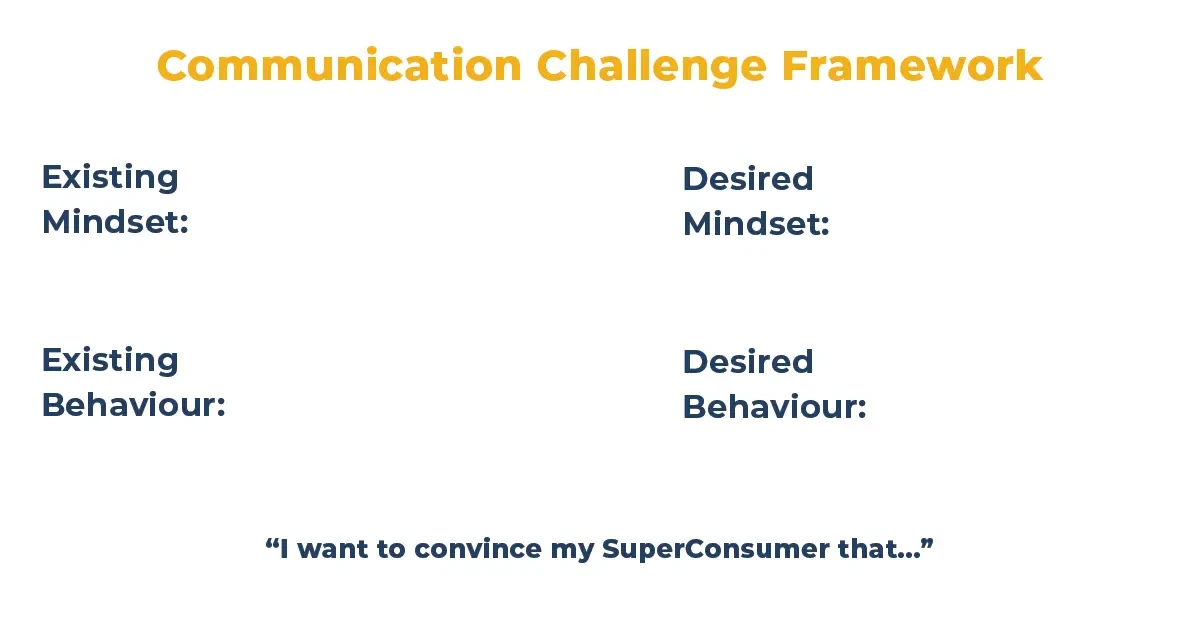

Communication Challenge

To create such a communication idea, we first need to be clear about the task at hand, which in Kraftshala lingo, we call the Communication Challenge. It is as articulated as the single thing that you want to convince the consumer of.

To craft an appropriate Communication Challenge, you can use the following structure:

What is the Current Mindset of the Target Consumer that you’d like to change?

What is the Current Behavior of the Target Consumer that you’d like to change?

What is the Desired Mindset that you’d like to instill in the minds of the Target Audience?

What is the Desired Behavior that you’d like to instill in the lives of the Target Audience?

State the Communication Objective as “The singular most important point that I want to convince my Target Consumer of is…”

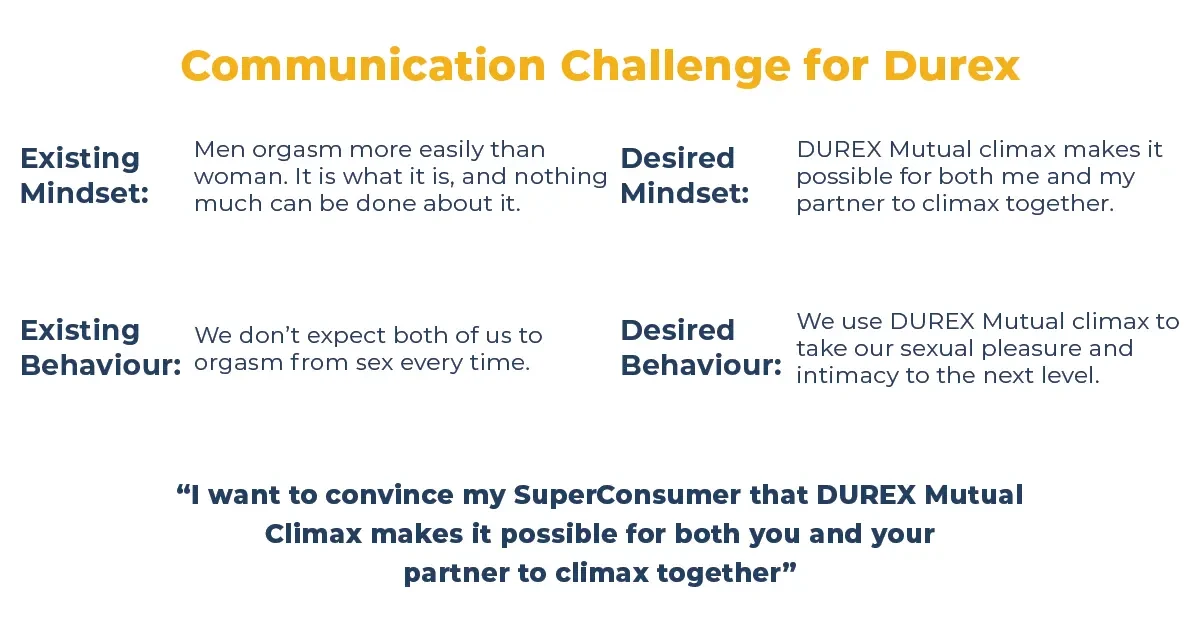

To illustrate this using our ongoing example of sexual wellness:

When crafting your Communication Challenge, you’ll need to ensure that it is clear and singular. Try to do too much and you’ll be able to land nothing.

Communication Insight

Once you have closed the Communication Challenge, your next step is to identify a relevant Insight which can be leveraged to create impactful brand communication.

A Communication Insight captures a human truth, or a set of human truths, that are a source of tension for your consumer, which your brand communication can ultimately resolve.

Why do we need a communication insight, you may ask? In simple words- because it’s incredibly hard to change human behaviour.

Insights are necessary because people are loathed to change their behaviour, and only do so when the motivation comes from a deep place within, often encapsulated in a hidden, unarticulated tension. In effect, an insight helps you discover an opening through which the consumer can move from the Existing mindset/ behaviour to the Desired mindset/ behaviour:

Learning how to discover and write powerful insights is a full 2-week module in our programs, but to give you a 1 line gist of the process, insights emerge when you ask one or more deep-dive questions such as “Why is this true” or “So what if it is true”, “How does this affect what people think, say and do” etc.

For instance, in the case of DUREX Mutual Climax, if you were to discuss with your consumer about

- Why it’s so hard to talk about sex with your partner (both)

- How it feels to not orgasm/ have a poor sexual experience when your partner has (woman)

- How it feels to not be able to sexually satisfy your partner (man)

- Whether they ever fake an orgasm to help their partner feel more secure (woman)

- Implications of poor sex on a relationship (both) etc

The resulting information should be able to help you craft a Communication Insight such as:

Talking about sexual pleasure can be hard with your partner, but if we don’t take care of each others’ fundamental needs (expressed or otherwise), the resulting unintentional “selfishness” can jeopardise even the healthiest of relationships.

Note how richer and deeper this is than a more basic articulation of the problem such as “Sex is so much better when my partner & me both climax together. It is such a shame that nature just hasn’t designed us that way. Wish there a way out!“

This is why your Product insight and Communication Insight, while obviously connected, can be expressed. In the case of DUREX, at the product insight level, we only captured the need for a condom that helps women to climax at the same time as men. At the communication stage, we go deeper to understand what it is that the consumer fundamentally believes in that we can leverage to drive adoption for DUREX Mutual Climax.

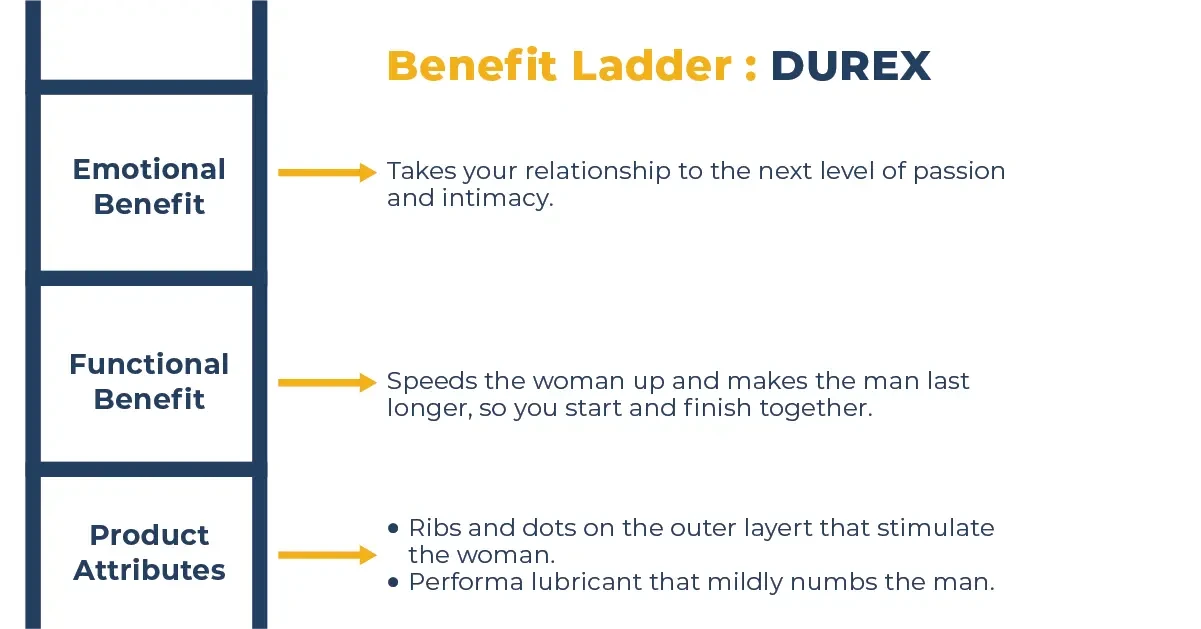

Benefits

Now that you have identified and articulated the problem part really well, you are ready to effectively solve it through brand solutions. To begin, you first need to identify what benefit you want to communicate. The best way to understand benefits is to understand through a ladder consisting of product/ service attributes, which layer up into a functional benefit, which in turn layers up to an emotional benefit. For instance, in the case of a gaming laptop, the ladder can be expressed as:

Notice that while there can be many attributes, a communication idea works best when it is singular, which is why all the attributes layer up to a single functional and emotional benefit.

In the case of DUREX, the ladder would look something like:

Finally, always keep in mind that the emotional benefit expressed in the ladder must resolve the Communication Insight articulated.

Big Idea

A Big Idea is the core idea that underpins all communications that will be launched by the brand.

It summarizes the key functional/ emotional benefit for the user and makes it memorable and actionable for them.

For the Mutual Climax condom by Durex, the Big Idea can be expressed as:

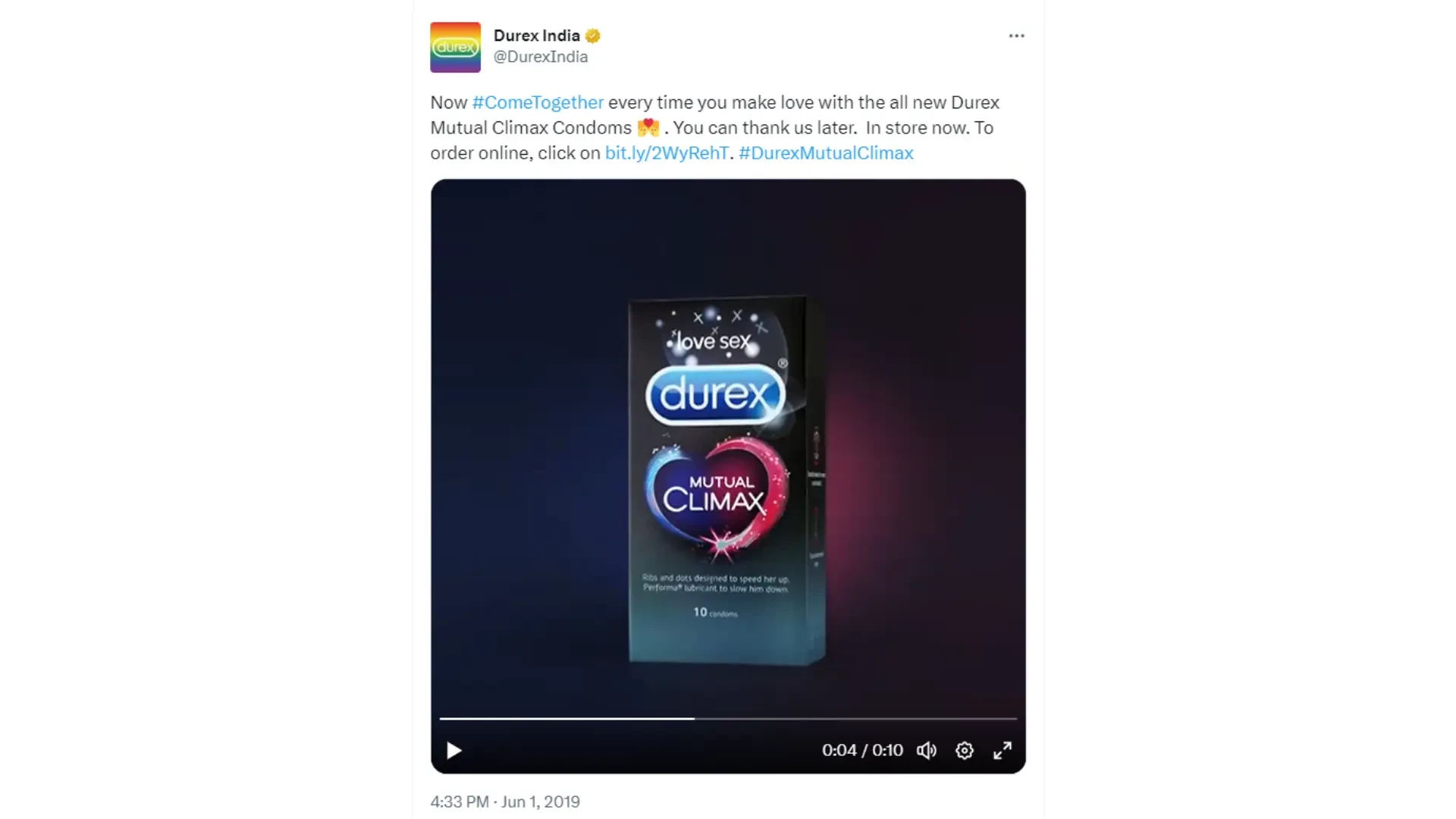

Come Together

DUREX Mutual Climax condoms speed her up and make him last, so both of you come together.

This Big Idea for DUREX Mutual Climax was brought alive through the following campaign on TV/ digital:

We’ll talk about how you should plan to amplify in 4.4.

4.2 Packaging / User Interface

Doesn’t it feel like the bulk of your work in your marketing journey is done now that the communication is over? You have created an awesome product with some amazing features to solve for a real consumer pain point. Nothing is going to stop you from success now. But here is where you might lose the plot.

Packaging for products or the user interface for an online app/service is the part where you bring your work together and the consumer experiences you for the first time- a zero moment of truth.

This is what a user sees on the shelf, this is what the consumers see on an ecom website amongst many other options, this is what they experience for the first time and judge whether you are true to what you have made them believe or not.

So imagine this – you see an ad for a super premium chocolate on TV. You love the message, you like the minimalism and you feel like you want to get your hands on it because of how premium it looks.

You go to a shop the next day, and there it is – the same chocolate. You reach out for it. And you pick it up – but oops! It is made of plastic and it doesn’t seem right! Why? They didn’t really promise whether it was going to be matt or glossy finish in their communication that got you interested! They didn’t even say that they are going to be with matt finish paper instead of the normal plastic that you get a cheaper chocolate in. So why doesn’t it feel right? The answer is fairly simple – they set an imagery in your mind. They made you believe that it’s exclusive – but when you touched it, it was just like any other cheaper alternative. And all the brilliant work that you have done on the product and communication would just go down the drain.

Packaging (product)/ User Interface (Service), in short, has 3 main roles –

- Get noticed & bought by a shopper at the moment of purchase: So the shopper is there in the category shelf. They perhaps have seen your ad or maybe not. But in that cluttered space on the shelf, the consumer is also lost in choices. Give them prompts and cues to help make their purchase decisions simpler for them.But to do that and get yourself noticed, it is highly critical to first be distinctive. And if you have got their attention, the next job is to communicate proposition or benefits are for them to buy you. Obviously price plays a role here and we will come to that in the next section. But with your packaging design you want to make sure that you are talking to the right person with the right messaging. For Mutual Climax condoms, the Black color was chosen as it stood out of the crowd and for a category which consumers are still hesitant to talk about, the color could act as a clue for the retailer to hand over this specific product. It also clearly denotes that its for both men and women and thus a strong differentiator vs the base brand. It’s always a good idea to create a digital snapshot of how your product would look shelved alongside the competitors or how the user will experience your service through mock-ups.

2. Add to the Shelf ROI for a retailer: A retailer would be giving some space to this product of yours. And space for a retailer is money – prime space which catches the attention of a shopper even more! So how can you create this product such that it adds to his ROI? This is why the shampoo sachets flew literally out of thin air and became a success in large part of the world where retail is dominated by small shops, because the packaging enabled the retailer to hang it – it didn’t occupy his shelf space so was not a disruption for him and yet it was right in front of the consumer. So what can you do with your packaging such that it adds to his shelf ROI?

3. Delight the consumer at the moment of consumption: The last part is when consumers are consuming the product. Is there something that you can do to delight them in that moment as well? Including a scoop for a washing powder enough for one load, or a pouch to carry a veet trimmer or a message when they open the lid of a chocolate box are all ways to delight them. And it goes without saying that if you don’t pay attention to this, it could even end up ruining their experience even without really consuming it. For instance, writing your MOP for your noodles brand exactly where they were supposed to tear away the wrapper from, or saving an extra dollar on your raw material costs by installing a cheaper zipper on your pouch which would take a lot of effort to open and close, or adding a lot of plastic in your packaging to wrap a glass bottle when you know the sentiment on plastic – all these are ways to kill your product after doing all the hard work!

As far as the packaging design goes, here are a few tips for that too:

- Branding – What is the parent descriptor relationship in your packaging and why? How much space do you want to give to the parent brand and how much to your descriptor or do you want to create a new sub-brand?

- Elements – What are the colours, shapes, images and words that you want to put on the packaging. What is the hierarchy of information and why? Keep in mind the brand color palette and aesthetics and what parts do you want to retain and which ones do you want to get rid of and why?

- Personality + Message – Does the packaging shout out what the communication is trying to convey. Does it connect with the person that you are trying to bring in?

4.3 Pricing

Pricing is not just a number. It is a core part of your strategy. It forms a part of your scoping as well as it helps in arriving at the revenues that you project over the years.

Pricing can act as a signal of quality or exclusivity or luxury. Pricing can be used to promise a better experience to your user. Did you know that there are dating apps out there where it takes close to INR 300 to send a single message? That price points helps the women on that app feel safer since the chances of non-serious interactions decrease.

Pricing can also be used to signal affordability to bring in or retain the masses. Think Tata Nano where they set out to create a car for INR 1 lacs to become the first car for a lot of Indians. Or the critical price point of INR 5 for FMCG industry (biscuits, shampoo, noodles, chocolates etc). In this case, you start from the price that the consumer is willing to pay, have a margin in mind and work backwards to arrive at the cost and thus optimize the product accordingly. The adjustments in product packaging, manufacturing, supply chain, distribution, etc. also forms a critical part of meeting the price point in this scenario. It is also possible that you may realize at this point that it is not feasible to hit the price point at all to provide the benefits at a reasonable quality. Some product innovations can get scraped off at this point, as is the case below:

Thus, for pricing working on both – a top-down and a bottom-up approach – helps us arrive at a price point which works for the consumer as well as the business.

4.4 Amplification: Media and Partnerships

So you have a great product that addresses a real pain point, and a powerful Communication Idea. The next step is to make sure that message actually reaches the audience.

On the face of it, this seems to be a straightforward problem to solve. Just buy ad spots on TV, digital (YouTube, Facebook, Instagram etc), radio, print and outdoors and every other media that people consume. Maybe throw in a few influencers and event sponsorships.

Sounds like a plan. But is it really one?

To quote our parents here- money doesn’t grow on trees.

The most misleading term in this history of marketing was the 360 degree plan, because no brand has sufficient money to be present everywhere. Not even mega brands have that kind of moolah, forget your new, unproven innovation.

An effective promotional strategy that utilizes media budgets effectively can really make the difference between an innovation dying out or getting those extra 6 months to be able to gain traction and kick start sustainable sales. This section is about spending money. And anytime that you are spending money, you want to ensure that it delivers a ROI.

The first step in creating an effective media strategy is to to understand the following:

- Which media platforms are my consumers spending time on?

- What kind of content are they consuming on those platforms? (genres/ formats/ specific shows)

- Why are they consuming this media/ content?

These are questions that you can ask in the initial consumer research part so you do not return to consumer interviews at this stage.

A point to note here is that your media target audience is always wider than your communication target audience, because the set of people are always wider than the way you define your SuperConsumer.

In the case of DUREX Mutual Climax, while a product like that obviously appeals to more women than any other condom brand in the market, the reality of the condoms category is that in most cases the actual brand choice and purchase is made by men. While the media plan for Mutual Climax might skew more towards women than the average DUREX campaign, it cannot just be running for women/ highly progressive couples- it’s targeting has to be much wider.

Once you have an exhaustive list of media and content your users are consuming, you need to decide the ones to partner with. Let’s share a few Golden Rules of Media Planning with you.

In the case of DUREX Mutual Climax, while a product like that obviously appeals to more women than any other condom brand in the market, the reality of the condoms category is that in most cases the actual brand choice and purchase is made by men. While the media plan for Mutual Climax might skew more towards women than the average DUREX campaign, it cannot just be running for women/ highly progressive couples- it’s targeting has to be much wider.

Once you have an exhaustive list of media and content your users are consuming, you need to decide the ones to partner with. Let’s share a few Golden Rules of Media Planning with you.

Rule 1: Talk to your consumer when they are most open to hearing your message.

It’s not enough to know who to target. To maximise RoI, you need to target them when they are most likely to be interested in your message.

To illustrate this, think of a hypothetical fashion brand that sells sophisticated fashion wear for women, many of whom are working professionals. Therefore, most of their target audience are on LinkedIn. Would it be a good idea for the brand to run ads on LinkedIn?

The truth is that RoI they’d get on ads running on LinkedIn, assuming the platform allows ads for fashion wear, would be much worse than Instagram. When people are on Linkedin, they are mostly thinking about professional learning, networking, career opportunities, and the likes.

Even if they see an ad for a fashion brand, their chances of noticing it and actually clicking on it are significantly lesser than on a platform more suited for visual content in general and fashion in particular.

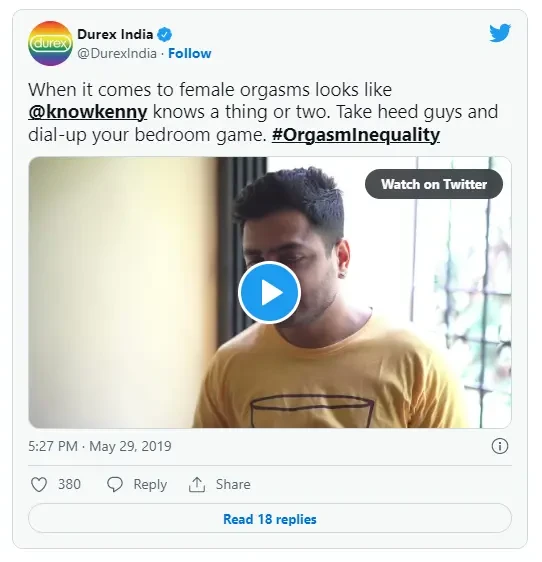

A corollary of Rule 1 is that if the issues you address are already top of my mind in your target audience, or can be brought top of my mind, then your consumers automatically become open to hearing more about the solutions you have to offer.

In the case of DUREX Mutual Climax, this would mean triggering conversations around orgasm before the campaign was released, which is exactly what they did. A few days before the campaign was launched, DUREX released a survey showing 70% of women don’t orgasm every time.

Rule 2: Collaborate with platforms and partners that lend credibility to your initiative while delivering reach

This one’s fairly straightforward to understand, and important to get right. If DUREX Mutual Climax had released a survey and done nothing more than run ads promoting the results it showed, it’s unlikely that it would have led to any serious level of conversations. To amplify the message, they instead worked with a set of celebs and influencers that are known to be progressive and fearless voices in India

The brand also did a live session with Pooja Bedi, a well-known progressive voice on sexuality, where she answered audience questions around fake orgasms and how to deal with them.

As the conversation starts to reach a crescendo, the new product is unleashed as a solution on June 1st exactly 4 days after the release of the survey.

Rule 3: Hearing the same message on multiple platforms works better than hearing it from one source only.

This one’s also self-explanatory. It’s the reason why brand builders don’t put all of their money on a single large platform (like TV), instead preferring to use multiple media to get the message across. The only problem with it is it needs to be used in conjunction with Rule 4, which is:

Rule 4: To break clutter on any medium, you need to achieve a threshold reach and frequency.

If you do not achieve a certain threshold reach and frequency, your entire money might be wasted, because consumers have not been exposed enough to your campaign for it to register, making the whole attempt an exercise in futility. Therefore, you need to be sure that you have enough investment planned behind each medium for it to even have a chance to succeed.

The money available is typically a function of the P&L you created in Section 3.3. Higher the margins you make on a product/ service, the more you can invest behind making it successful.

And thus, keeping the Golden Rules of media planning in mind, your objective here is to chart out an integrated media strategy for your innovation.

Things to build in your media and amplification plan:

- Phases of media plan – How do you want to divide your plan to generate max ROI? Is there a pre-launch phase that you want to plan – if yes, why? Would you rather invest in pre-launch or run your campaigns after the stocks have reached the market and add more weeks to your campaigns to directly impact the sales?

- Geographies – What would be your focus markets and why? Is there a priority order here?

- Media Vehicles (TV, Print, Radio, Outdoor, Digital, Apps, Ecom) – What are the channels that you will go after and why? Are there any special integrations that you can plan in any of the channels which fits in your overall campaign idea? What will be your overall budget split across your various options selected and why? Prioritize different options basis expected acquisition costs and the number of conversions you expect them to drive.

- How would you tailor your big idea to suit each channel? Showcase to us how the messaging would look for different channels.

- Organic Strategy – Is there any way to generate impressions/views/clicks (whatever KPI is important for you) by creating content? What sort of content should it be? What would the content calendar look like here? How does it add value to the user and why would they care? Is there a role of PR? Be open to explore other content marketing formats such as webinars, podcasts etc.

4.5 Distribution

A distribution plan, like packaging/ pricing etc, needs to flow logically from the proposition itself. You can build a plan based on the following basic principles –

- You should be available in places where the shoppers are most likely to buy you

- You should be visible in those places such that the shopper does not miss seeing you

- You should be easily accessible in those places as much as possible so that shoppers can experience you. In the ecommerce context, this principle relates to the quality of your product or brand pages which gives all possible details to the consumer

For arriving at your distribution plan, start by answering the following questions for yourself

- Who is the shopper going to be?

- Where are the consumers/shoppers when the need arises?

- Where all does the consumer shop currently? This can open up some interesting distribution ideas. For example, a diapers brand stocking their products at baby care creches for purchase by parents before dropping off their babies.

- What are their different shopping missions and where do these happen? Shopping missions could be regular monthly shopping, top-up shopping, immediate shopping, experiential shopping, etc

Based on the above information, you can start narrowing down on the channels using the following –

- How attractive is the channel – no. of stores, offtake from every store, growth of that channel for overall category, profitability of that channel (E.g. Walmart might be less profitable than an independent store as it requires the company to give a higher margin) etc.

- How likely are you to win – How strong is your existing distribution structure for this, How good is your ability to take share in this channel, how closely does it align to your way of doing business and sales etc.

There could be more factors for each of the above. Use your best judgement to prioritize your channels as that can help you determine the investment that you want to make in each channel.

For DUREX Mutual Climax

To finalise priority geographies:

- Attractiveness was determined by the size of market- essentially the largest cities in the country.

- Likelihood to win was determined by looking at market share of base DUREX products as an indication of brand strength and ability of the consumers to pay the requisite premium (remember, the base DUREX range was already ~2X of other branded competitors, and Mutual Climax was ~3X of competitors’ pricing).

A similar logic was used to prioritise channels like ecommerce, pharmacy chains (Modern Trade) and independent pharmacies/ medicine stores in major cities where relatively large clusters of target audience exist.

E-commerce was obviously a high potential category for DUREX Mutual Climax because

- There are no awkward conversations to be had with the retailer- the product is delivered in a discreet packaging straight to home

- It fits the profile of the consumers being targeted- the online platform naturally skews to young, high-end consumers who are also typically more progressive.

However, since the bulk of the category purchase happened in traditional trade, it was a channel that needed to be cracked as well. From a shopper and trade perspective, the condoms category presents an interesting challenge.

- On one hand, retailers in many countries prefer to not prominently display condom packs or condom related communication in their stores because they fear many of their customers will not approve (due to societal taboos around discussing sex)

- On the other hand, as the most well known brand in the category with a cool, premium packaging design, the more prominently DUREX is visible to a shopper, the higher the chances of them purchasing it over a cheaper competitor

Therefore, a large part of the sales team’s effort went into incentivising and encouraging retailers to display DUREX inside their stores.

Things to build in your distribution plan:

Basis the above research and analysis on shopper and trade behaviour, start constructing your distribution plan

- Which geographies should you launch in?

- What types of stores do you want to launch in?

- What kind of retailer margins can you afford to offer your trade partners?

- What are the sell-in quantities for each store?

- What are the visibility guidelines that you want to follow?

- What are the special things that you can do on online channels of distribution?

Do remember that your distribution plan needs to make business/financial sense.

Let’s understand this further by going over how is the sales / distribution system structured for an FMCG

- Products are manufactured in factories, which are then sent to warehouses, which are then sent to distributors and are then sent to retailers or smaller wholesalers and so on.

- For selling the products to a retailer, you will have salesman going to them and convincing them to try this new product

- The retailer should not only buy it, but also push it to consumers or maybe give a prominent place in the store which will cost the company money.

- In case the product does not sell, you will have to take it back and compensate the retailer to protect your goodwill and confidence of the retailer in your company.

- You might also have to give some additional discounts, incentives or visibility payouts or additional margins.

- A new product will also require a special focus from your sales team and they will track the performance and push their teams to meet the targets for this launch and this will come at the cost of some other product.

Each of the above things has a cost associated with it and thus a distribution plan needs to be in tandem with your media plan. Distribution is about fulfilling demand and you want to fulfil demand in places where you have generated demand for the return on investment and return on effort to be optimized.

A final word- far more innovations have been lost due to faulty distribution planning than you can imagine.

The most common mistake that amateur business professionals make WRT to the distribution plan is to spray the product in the wrong places, or even worse, all places possible. What would happen if a premium offering like DUREX Mutual Climax is planned to be sold at a small random medicine shop in a remote area? For one, it would be super expensive to convince the outlet owner to stock your product. It would be expensive to deliver that product in a market where you are not as likely to succeed in the first place. And if that product doesn’t move from the outlet’s shelves, they are not going to stock it again, and worse are unlikely to be that easily persuaded for any future innovations you launch. Imagine a company like Reckitt that already sells a number of power brands and has a large existing business. The moment the trade feedback on the product isn’t positive, the sales and distribution team is going to prioritise other items, thus further reducing the likelihood of success.

You would have been better served to have picked key channels in some major cities for the launch phase (based on the principle of attractiveness and likelihood to win), and then gradually expanded the outlet base as the product acceptance and demand grew. Ironically, by planning to sell less, you give your innovation the best chance of selling more in the long term.

Written by Eshu Sharma, Nishtha Jain and Varun Satia, co-founders at Kraftshala. Thanks to Anupriya Singhal, Shweta Dogra, Ratika Mehra, Alok Sinha, Jaiveer Duggal, Ankita Chakraborty, Saranya Mukherjee, Shikha Dsouza and a host of former participants of the Reckitt Global Challenge for sharing their inputs and perspectives. Design and illustrations by Geetika Sharma.